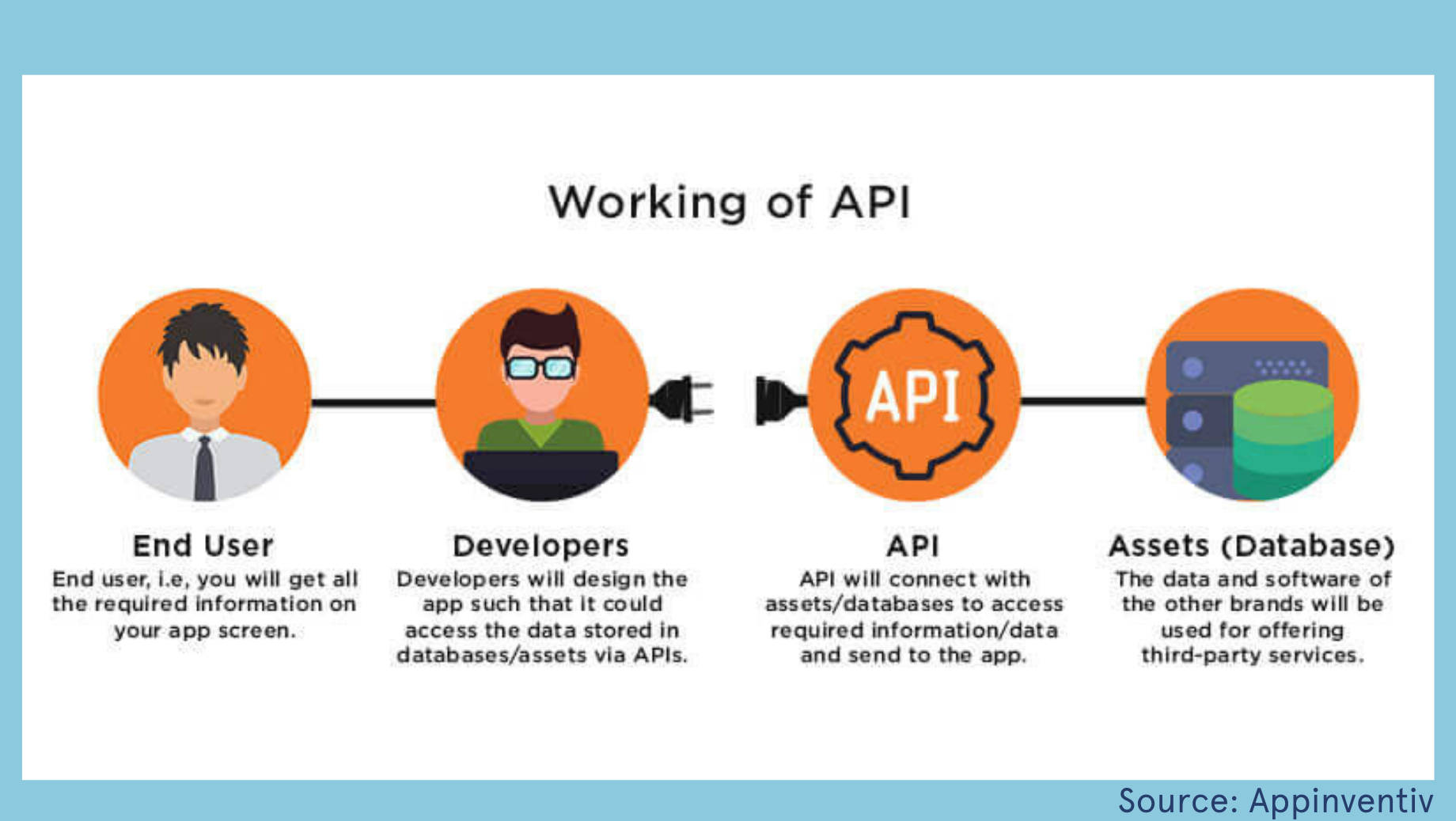

A fintech API, or Application Programming Interface, is a set of rules and protocols that allow different software applications to communicate and interact with each other in the financial technology (fintech) ecosystem. It defines how different components of fintech systems can access and exchange data, perform operations, and utilize the functionalities provided by the API provider.

Here’s how a fintech API typically works:

- API Provider: The fintech company or organization offering the API is the API provider. They expose their APIs to enable access to their services, data, or functionalities by external developers, partners, or other applications.

- API Documentation: The API provider provides documentation that outlines the specifications, rules, and guidelines for interacting with their APIs. This documentation typically includes details about the API endpoints, data formats, authentication methods, available operations, and any specific requirements or limitations.

- API Access and Authentication: Developers or businesses interested in utilizing the fintech API obtain access credentials, such as an API key or access token, from the API provider. These credentials authenticate their requests and allow them to access the API’s functionalities securely.

- API Requests: Using the documentation and access credentials, developers or businesses can make requests to the API endpoints. These requests are typically made using standard HTTP methods such as GET, POST, PUT, or DELETE, and may include additional parameters or data depending on the API’s requirements.

- API Responses: Upon receiving an API request, the API provider processes the request, performs the necessary operations, and generates a response. The response is typically returned in a structured data format, such as JSON (JavaScript Object Notation) or XML (eXtensible Markup Language), containing the requested data or indicating the outcome of the operation.

- Error Handling: In case of errors or exceptions during the API request processing, the API provider generates error responses that provide information about the encountered issue. This allows developers to handle errors gracefully and make appropriate adjustments in their application.

- Data Integration and Utilization: Developers or businesses can integrate the data or services obtained from the fintech API into their own applications, systems, or platforms. They can use the data for various purposes, such as displaying financial information, conducting analysis, making payments, initiating transactions, or building value-added services on top of the fintech API’s functionalities.

- Ongoing Maintenance and Updates: API providers are responsible for maintaining and updating their APIs to ensure security, performance, and compatibility with evolving technologies and requirements. They may release new versions of the API or deprecate older versions, notifying developers and providing migration paths as necessary.

By providing access to their services and data through APIs, fintech companies enable developers and businesses to leverage their capabilities, integrate with their platforms, and build innovative financial applications and solutions. APIs facilitate seamless communication, data sharing, and collaboration, driving fintech innovation and creating a more interconnected and efficient financial ecosystem.

Fintech API services

Fintech API services refer to the application programming interfaces (APIs) provided by financial technology (fintech) companies to enable developers and businesses to access and utilize their financial services and data. These APIs allow different software systems to interact with each other, enabling seamless integration and communication between fintech platforms and third-party applications.

Fintech API services can encompass a wide range of functionalities, depending on the specific offerings of the fintech company. Some common examples include:

- Payment Processing: APIs that facilitate payment transactions, such as processing credit card payments, enabling peer-to-peer transfers, or integrating with digital wallets and mobile payment systems.

- Account Information and Aggregation: APIs that allow access to account balances, transaction histories, and other financial data, enabling businesses to aggregate and analyze financial information from multiple sources.

- Identity Verification: APIs that provide identity verification and authentication services, such as Know Your Customer (KYC) processes, digital identity verification, and fraud prevention measures.

- Lending and Credit Services: APIs that enable businesses to offer lending and credit-related services, such as loan origination, credit scoring, loan management, and underwriting processes.

- Investment and Wealth Management: APIs that provide access to investment and wealth management services, including portfolio management, investment advisory, trading, and market data.

- Financial Data and Analytics: APIs that offer access to financial market data, real-time stock quotes, economic indicators, and other financial analytics to power applications and services.

- Compliance and Regulatory Solutions: APIs that assist businesses in complying with financial regulations and reporting requirements, such as anti-money laundering (AML) checks, sanctions screening, and regulatory reporting.

By exposing these APIs, fintech companies empower developers and businesses to build their own applications, integrate fintech services into existing systems, and create innovative solutions that leverage the fintech company’s capabilities. This promotes collaboration and fosters the growth of the fintech ecosystem.

How Does the Fintech and Banking Sector Use APIs?

The fintech and banking sectors extensively utilize APIs to enhance their services, improve operational efficiency, and foster innovation. Here are some common use cases for APIs in the fintech and banking sectors:

- Integration with Third-Party Services: APIs allow fintech and banking platforms to integrate with third-party services seamlessly. For example, banks can integrate payment gateway APIs to enable online transactions, or they can integrate APIs of credit bureaus to assess the creditworthiness of applicants.

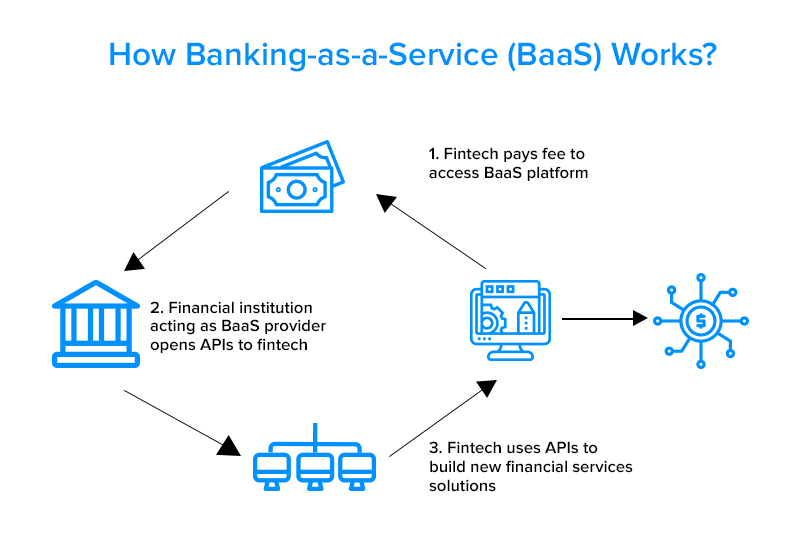

- Open Banking: APIs play a crucial role in open banking initiatives, where banks provide secure access to customer data to authorized third-party developers. Through APIs, fintech companies and other financial service providers can access customer account information, initiate payments, and offer value-added services.

- Payment Processing: Fintech companies and banks utilize payment APIs to process transactions, whether it’s enabling online payments, mobile payments, or integrating with digital wallets. APIs streamline the payment process and ensure secure and reliable transactions.

- Account Aggregation: APIs enable fintech platforms to aggregate and consolidate financial data from multiple sources, including bank accounts, investment accounts, and credit cards. This allows users to have a comprehensive view of their finances within a single application or platform.

- Identity Verification and KYC: APIs are used for identity verification and Know Your Customer (KYC) processes. They enable fintech platforms and banks to verify user identities, perform background checks, and comply with regulatory requirements while ensuring a smooth onboarding experience.

- Lending and Credit Services: APIs are leveraged by fintech companies and banks to automate and streamline lending and credit processes. APIs enable credit scoring, loan origination, underwriting, and loan management, making the process more efficient and accessible.

- Market Data and Trading: APIs provide access to real-time market data, stock prices, and other financial information. Fintech platforms and trading applications use these APIs to deliver up-to-date information to users, enable trading functionality, and build investment and wealth management tools.

- Risk Management and Compliance: APIs assist in risk management and compliance by providing access to anti-money laundering (AML) and fraud prevention services. Fintech and banking platforms can integrate these APIs to identify potential risks, monitor transactions, and ensure compliance with regulatory frameworks.

Overall, APIs play a crucial role in enabling collaboration, data sharing, and innovation within the fintech and banking sectors. They allow different systems and platforms to interact, leading to enhanced user experiences, increased efficiency, and the development of new financial services and products.

Why API’s are the future of fintech innovation

APIs are considered the future of fintech innovation for several reasons:

- Seamless Integration: APIs enable seamless integration and communication between different fintech platforms, systems, and applications. They provide a standardized way for these entities to interact and share data, allowing for easier collaboration and interoperability. This seamless integration fosters innovation by facilitating the development of new solutions that leverage the capabilities of multiple fintech services.

- Speed and Efficiency: APIs allow fintech companies to accelerate the development and deployment of new products and services. By leveraging pre-built APIs, developers can save time and effort by utilizing existing functionalities and infrastructure. This increased speed and efficiency in developing new solutions drive innovation within the industry.

- Access to Data and Services: APIs provide access to valuable financial data and services that can be leveraged by fintech innovators. With APIs, developers can tap into banking and financial data, payment processing systems, credit scoring services, and other functionalities, enabling them to build new applications, improve existing services, and create unique customer experiences.

- Collaboration and Partnerships: APIs foster collaboration and partnerships between fintech companies and other organizations. By exposing APIs, fintech providers can offer their services to third-party developers, allowing them to build upon their platforms and create innovative solutions. This collaborative approach encourages the exchange of ideas, promotes ecosystem growth, and drives fintech innovation.

- User-Centric Experiences: APIs enable the creation of personalized and user-centric experiences. By integrating different fintech services and data sources, developers can deliver comprehensive and tailored solutions that meet the specific needs of users. This focus on user experience fosters innovation by providing customers with more convenient, efficient, and customized financial services.

- Open Banking and Regulation: APIs are instrumental in the implementation of open banking initiatives, which aim to increase competition and consumer choice in the financial industry. APIs enable secure access to customer data, allowing third-party developers to build innovative services on top of banking infrastructure. Open banking fosters fintech innovation by encouraging the development of new products and services that leverage banking data and capabilities.

- Scalability and Flexibility: APIs provide scalability and flexibility for fintech companies. As they grow and evolve, these companies can offer new APIs or enhance existing ones to meet the changing needs of their users and partners. This adaptability enables continuous innovation and improvement within the fintech ecosystem.

In summary, APIs are the future of fintech innovation because they enable seamless integration, accelerate development, provide access to data and services, foster collaboration, drive user-centric experiences, facilitate open banking, and offer scalability and flexibility. By leveraging APIs, fintech companies can unlock new opportunities for innovation, create value-added services, and enhance the overall financial experience for customers.

Read More : U.S. aims to turn middle-American cities into new tech hubs with $500 million investment